Income Tax Rates 2025-25. A quick guide to 2025/25 tax rates, bands and allowances. Read telegraph money’s guide to uk income tax bands and rates to find out more.

Tax is paid on the amount of taxable income remaining after the personal allowance has been deducted. The amount of income tax you deduct from your employees depends on their tax code and how much of their taxable income is.

Tax rates for the 2025 year of assessment Just One Lap, Moneysavingexpert’s guide to tax rates for 2025/25 including tax brackets, national insurance, capital gains tax and more

Tax Rates 2025 25 Image to u, On 25 january 2025, the government announced changes to individual income tax rates and thresholds from 1 july 2025.

Uk Tax Rates 2025/25 Remy Valida, The financial year for tax purposes for individuals starts on 1st july and ends on 30 june of the following year.

Rates And Thresholds 2025 25 Image to u, Read telegraph money’s guide to uk income tax bands and rates to find out more.

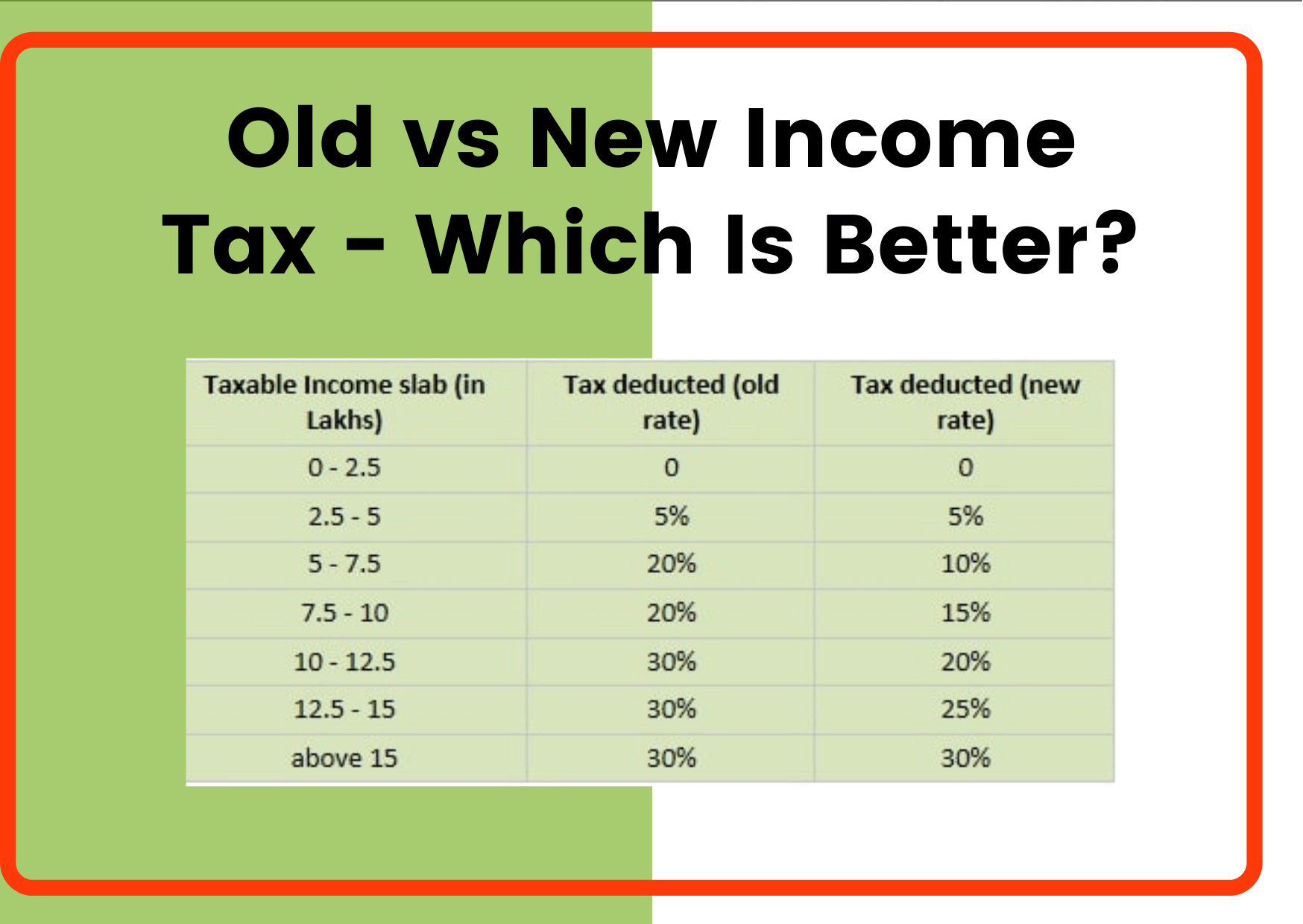

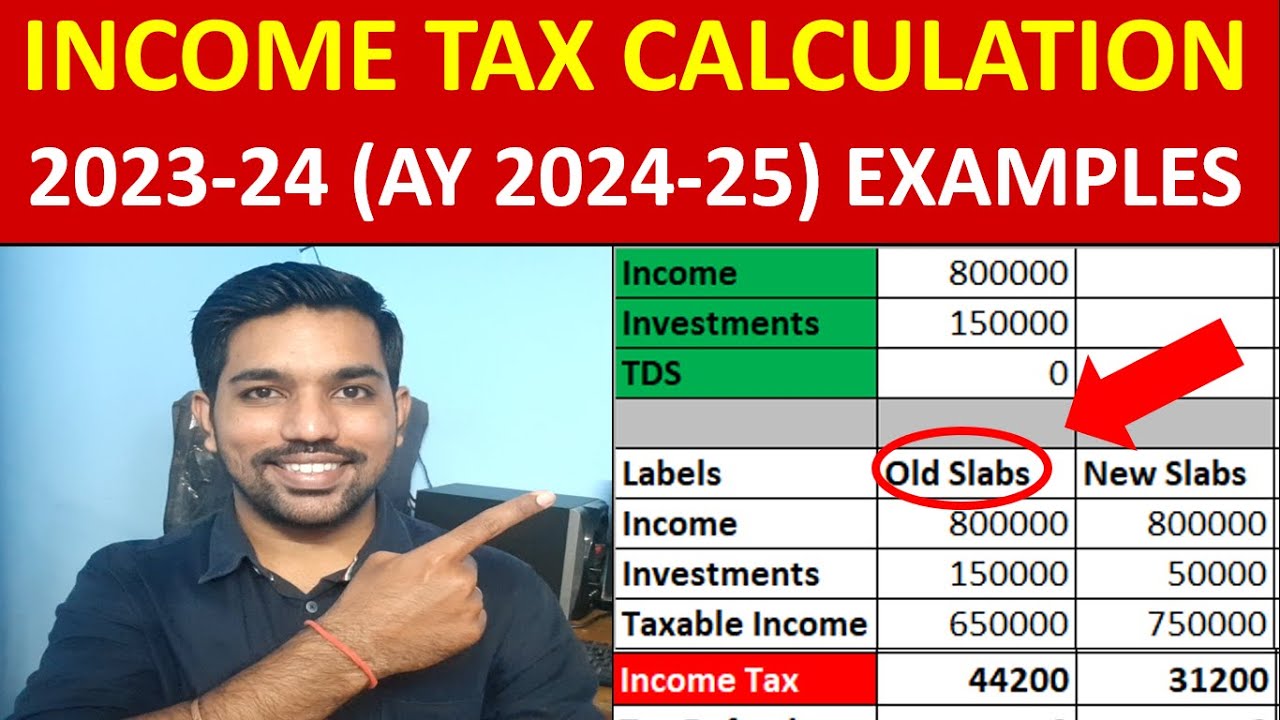

Know the New Tax Slab Rates for FY 202324 (AY 202425, Through a direct comparison of the old and new regimes, including detailed budget 2025 income tax slabs and rates, the article aims to provide taxpayers with the.

Tax Slab Rate Calculation for FY 202324 (AY 202425) with, The basic rate (20%), the higher rate (40%), and the additional rate (45%).

Tax Rates For Ay 2025 25 Image to u, If you're in doubt as to the suitable course of action we recommend you seek tax advice.

Tax Brackets 2025 Federal Irene Leoline, The basic rate (20%), the higher rate (40%), and the additional rate (45%).

Tax Rates For Assessment Year 2025 25 Image to u, For the 2025/25 tax year the pension annual allowance remains unchanged at £60,000 and the charge on excess is at applicable tax rates on earnings.

2025 State Tax Rates and Brackets, For the 2025/25 tax year the pension annual allowance remains unchanged at £60,000 and the charge on excess is at applicable tax rates on earnings.